If you are aware of your picked out charity plans to (or could perhaps) use your automobile for internal use and it’s worth over $five,000, you should get an independent appraisal.

This can change by location and charity, but quite a few will Allow you to donate which has a copy with the Loss of life certificate and signature of your estate's executor.

What forms of automobiles does Vehicles for Houses accept? Don’t Permit the name fool you. We acquire in a number of automobile donations that roll and float, even when they are retired from use. Find out more

“I hope this car can be utilized by someone who will restore it or use its components. In addition to my interest in alternate fuels, I am also hopeful that housing can become more affordable Which common people can improve their odds of owning a house.

Numerous businesses match personnel donations. You can double your effect for neighborhood kids at no further cost for you!

Verify with all your tax preparer to view if you'll be qualified or not. You can also consult with them about any Advantages in case you file Condition taxes.

Once you simply call or fill out our on line donation sort you must have the title and present-day mileage in hand.

If the value is down below $five,000, You here should use well-known and highly regarded guides to estimate the industry worth by your self, but the IRS will explore it with far more detail.

On top of that, your donation aids businesses to provide support to disabled veterans as well as their people. Understanding that the car or truck donation allows to offer transition services, aid for homeless veterans, advocacy, work help plus much more is something you can be pleased with.

Many donation programs nearby to Alafaya and Nationally will Fortunately click here take other types of cars like bikes, RVs, Boats, 4x4s, and a lot more! If you have a vehicle you'll need to eliminate, this is usually a choice truly worth investigating!

In addition to supporting the plans you're keen on, your gift could make you a member of IPR (if you are not already!). The proceeds out of your donation website will gas the information and music you depend upon and like — It really is a fairly easy way for making a big big difference.

Kind 1098-C includes 3 copies: A, B, and C. The charity data files Copy A With all the IRS and sends you Copies B and C. You then file Copy B using your tax return in order to declare a deduction of more than $five hundred and preserve Duplicate C in your information.

️ How do I read more routine pickup and disposal of my auto sections? It’s super simple to program pickup and disposal of one's previous car or truck or auto elements with us! Just stop by our on line reserving process, opt for a day and time that works for you, and our Loaders will arrive to take away every thing you require to remove.

What ever reason you’re looking to unload an previous car, donating it to charity can sometimes assist you to get charity car donation much more price than investing it in if you can take the charitable contribution deduction.

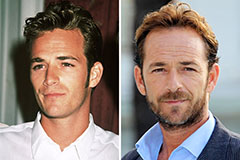

Luke Perry Then & Now!

Luke Perry Then & Now! Jenna Von Oy Then & Now!

Jenna Von Oy Then & Now! Macaulay Culkin Then & Now!

Macaulay Culkin Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now!